Investment type

- Secondary buyout

A combination of new facilities and an acquisition supported the growth of specialist manufacturer.

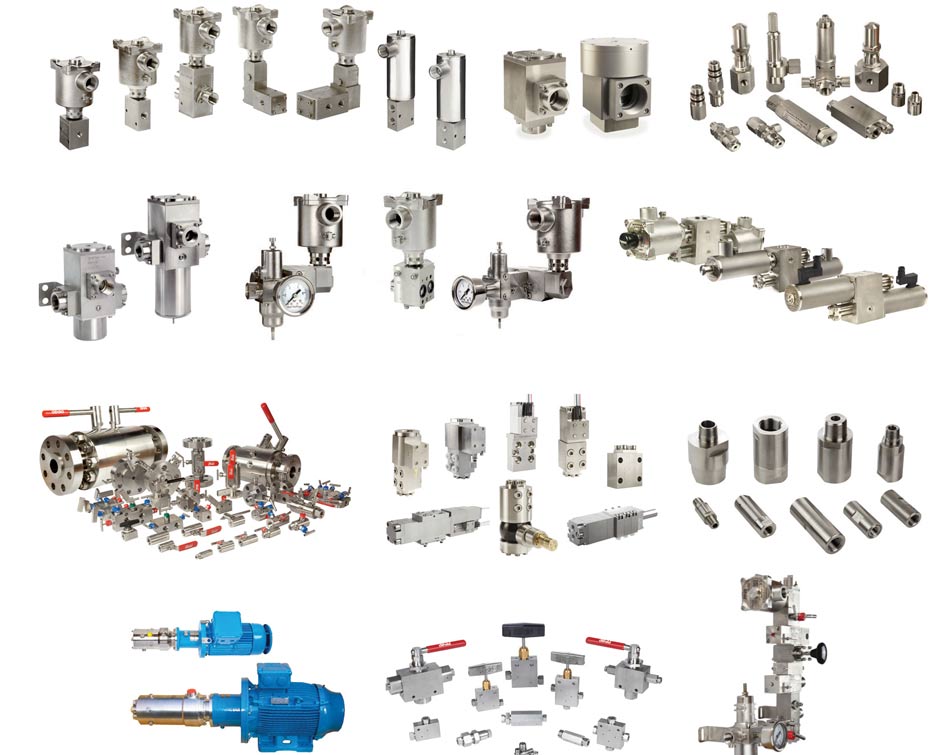

Bifold is a leading designer, manufacturer and distributor of instrument valves and pumps to the oil and gas sector.

April 2012

August 2015

£125m

Bifold designs and manufactures instrument valves and pumps used in the oil and gas sector. The business prides itself on having built a reputation for producing products that are of the highest quality and impervious to hazardous, corrosive and subsea environments.

Creating a well-oiled business

In April 2012, we supported a management buyout of the group from its previous private equity owners, with the management team retaining the controlling stake in the business.

Management wanted to identify a new partner to support the company’s future growth and fine-tuning of the business. Our depth of expertise meant we emerged as the partner of choice.

Gary Jacobson, CEO

Bifold

During our partnership, Bifold moved into new state-of-the-art 30,000 sq. ft manufacturing facilities in Oldham, Greater Manchester, to increase capacity and its technical capabilities. It also completed the acquisition of Orange Instruments, which offered the business access to a range of specialist control system products.

Globally competitive

In August 2015, LDC exited its investment in Bifold Group to Rotork plc, a FTSE 250 company in a £125m deal, delivering a 2.4x money return for LDC.